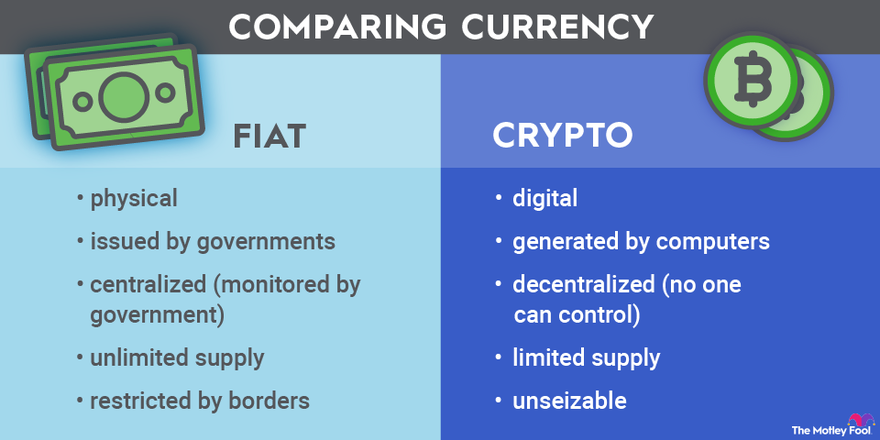

Consider this: Bitcoin, the first cryptocurrency, has only been around since 2009, yet it already poses a significant challenge to traditional fiat systems. This rapid adoption highlights a mere glimpse into why experts increasingly believe digital currencies could supersede traditional money. The primary allure is their decentralized, borderless nature, bypassing traditional banking constraints and offering peer-to-peer transfers with unparalleled speed.

Historically, financial transactions have relied heavily on intermediaries. Cryptocurrencies, however, utilize blockchain technology to enable direct exchanges, diminishing the need for traditional banks. A survey by Finder revealed that approximately 22% of Americans own some form of crypto. This rising interest underscores significant shifts in global financial systems, driven by the promise of transparency, security, and reduced transaction costs.

:max_bytes(150000):strip_icc()/Cryptocurrencyovertradingapp-3b7855f531754d128fed81555549a552.jpg)

Why Cryptocurrencies Could Replace Fiat Currencies?

One major reason cryptocurrencies might replace fiat currencies is their unparalleled speed and convenience. Cryptocurrencies enable instant transactions, unlike traditional banking, which can take days. Furthermore, no intermediaries are needed for these transactions, which can reduce costs significantly. This efficiency is especially beneficial for international transfers, which are often costly and time-consuming. Cryptocurrencies streamline the process, making financial interactions more seamless and less burdensome.

Additionally, cryptocurrencies operate on blockchain technology, which offers unmatched security and transparency. Each transaction is recorded on a decentralized ledger, making tampering nearly impossible. This reduces the risk of fraud and corruption, both of which are prevalent in traditional banking. Moreover, the transparency provided by blockchain can increase trust among users. Such features make cryptocurrencies appealing as a safer alternative to fiat money.

The growing popularity and acceptance of cryptocurrencies are further making a case for their replacement of fiat currencies. More businesses are beginning to accept Bitcoin, Ethereum, and other cryptocurrencies as a form of payment. Reports show that several countries are developing their own digital currencies, providing more legitimacy to the concept. As adoption widens, public trust in cryptocurrencies will likely increase. This shift could lead to a broader acceptance of digital currencies over traditional ones.

However, the transition to cryptocurrencies is not without challenges. Issues like regulatory uncertainty and market volatility pose significant hurdles. Governments around the world are still figuring out how to regulate these digital assets. Additionally, the fluctuating value of cryptocurrencies can be a barrier for some. Despite these challenges, the advantages of speed, security, and growing acceptance make a compelling case for why cryptocurrencies could one day replace fiat money.

The Unmatched Speed and Convenience of Cryptos

Cryptocurrencies offer a level of speed and convenience that traditional banking can’t match. Transactions made with cryptos are processed almost instantly, regardless of geographical location. This can be a game-changer for businesses and individuals working across borders. No more waiting days for bank transfers to clear. You can send money to anyone, anywhere, in a matter of seconds.

Additionally, cryptos streamline the process by cutting out the middlemen. Traditional financial transactions often involve multiple intermediaries like banks and payment processors. These intermediaries not only slow down the process but also add extra fees. With cryptocurrencies, users can make direct transactions without these hurdles. This reduced complexity makes financial interactions much simpler and quicker.

Another key advantage is the convenience of having a digital wallet. Unlike carrying cash or cards, digital wallets store all your cryptocurrencies securely. Many people find it easier to manage their finances using a digital wallet on their phone or computer. This accessibility ensures you can make transactions whenever and wherever you need. Plus, it adds an extra layer of security for your assets.

The use of cryptocurrencies also removes the need for currency conversion. This is particularly useful for international travel or online shopping from foreign retailers. Instead of dealing with exchange rates and conversion fees, you can simply use your digital coins. This aspect of cryptos saves time and money. It enables a seamless financial experience, both locally and globally.

Blockchain Technology as a Game Changer

Blockchain technology has revolutionized the way we think about data and transactions. At its core, blockchain is a decentralized ledger that records all transactions across a network of computers. This means no single entity has control, making it extremely secure. The decentralized nature of blockchain helps prevent fraud and unauthorized access. It provides a transparent and permanent record of each transaction.

One of the most significant features of blockchain is its transparency. Every transaction is visible to all parties on the network, ensuring complete honesty. This transparency is invaluable for industries like banking, where trust is crucial. Because every transaction is recorded and immutable, disputes can be resolved quickly. The clear, unchangeable records make it easier to track and verify activities.

Moreover, blockchain technology can streamline operations by automating processes. Smart contracts, which are self-executing contracts with terms directly written into code, play a key role here. These contracts automatically enforce agreements when predefined conditions are met, reducing the need for intermediaries. This increases efficiency and reduces costs in various sectors. From supply chain management to real estate, blockchain simplifies complex transactions.

Blockchain also enhances security through its cryptographic algorithms. Each block in the chain is linked to the previous one and secured using cryptography, making it nearly impossible to alter. This high level of security is crucial for protecting sensitive data. Cryptocurrencies, like Bitcoin, rely on this technology to ensure secure transactions. As more industries adopt blockchain, its security benefits will only grow.

The Growing Popularity and Acceptance of Cryptocurrencies

Over the past decade, the popularity of cryptocurrencies has skyrocketed. More and more people are investing in digital currencies like Bitcoin and Ethereum. This growing interest is not limited to individual investors; businesses and institutions are also jumping on board. Major companies like Microsoft and Tesla now accept Bitcoin as a form of payment. The mainstream acceptance of crypto is gaining momentum.

The increased acceptance is partly due to the benefits cryptocurrencies offer. Fast, secure transactions make them appealing for both buyers and sellers. Additionally, lower transaction fees compared to traditional banking provide a cost-effective alternative. As a result, many online retailers have started accepting digital currencies. This trend is expected to grow as more benefits become evident.

Governments are also beginning to see the potential in cryptocurrencies. Several countries are developing their own digital assets or considering regulations to integrate them into their financial systems. The U.S. Federal Reserve and the European Central Bank, for instance, are researching central bank digital currencies (CBDCs). These efforts show a significant shift toward wider acceptance of digital financial systems. It may eventually lead to legal frameworks that support the broader use of cryptocurrencies.

Another driver of cryptocurrency adoption is its increasing utility. People are using cryptos for more than just investment; they are paying for goods and services, transferring money, and even donating to charities. Blockchain technology enables these transactions to be quick and efficient. The more uses people find for digital currencies, the more ingrained they become in everyday life.

A variety of industries are finding unique ways to integrate cryptocurrencies. For instance, the gaming industry offers rewards in digital currencies, while the real estate market allows property purchases using Bitcoin. These practical applications support the growing popularity of digital currencies. They also help to build trust and familiarity among users.

Moreover, the rise of decentralized finance (DeFi) projects has added another layer of acceptance. DeFi platforms allow users to borrow, lend, and earn interest on cryptocurrency assets without traditional intermediaries. This innovation is reshaping the financial landscape. With DeFi’s growing success, cryptocurrencies are reaching new heights of popularity and acceptance.

Security and Transparency in Crypto Transactions

One of the standout features of crypto transactions is their high level of security. Unlike traditional banking systems, cryptocurrencies use advanced cryptographic techniques to secure transactions. Each transaction is verified and added to a public ledger, known as the blockchain. This makes it nearly impossible to alter or forge transactions. Users can trust that their assets are safe in the digital realm.

Transparency is another significant advantage that crypto transactions offer. Every transaction made on a blockchain is visible to all participants in the network. This level of openness ensures that transactions can be independently verified. It reduces the chance of fraud and ensures that everyone playing by the rules can see what’s happening. This kind of transparency boosts confidence among users.

The combination of security and transparency makes cryptocurrencies particularly useful for various applications. For example, charitable organizations can use blockchain to ensure that donations are used appropriately. Donors can track their contributions, knowing exactly how their money is spent. This builds trust between the donor and the organization.

Moreover, businesses benefit greatly from these features. Smart contracts enable automated and secure transactions, reducing the need for manual oversight. These contracts self-execute when specified conditions are met, ensuring both parties adhere to the agreement. This increases efficiency and minimizes the chance of disputes. It also reduces administrative costs, making business operations smoother.

Criminal activities and money laundering are enormous challenges in traditional banking, but crypto transactions can counter these issues effectively. The transparent nature of the blockchain allows for easy tracking of suspicious activities. Regulatory bodies can monitor transactions more efficiently, potentially reducing criminal misuse. This shows how cryptocurrencies can contribute to a safer financial system.

It’s important to acknowledge the criticisms, especially concerning privacy. While transactions are transparent, they are also pseudonymous. This means that no personal information is attached to the transaction IDs, protecting user privacy. However, this raises concerns about anonymity being used for illegal activities. Balancing transparency with privacy remains a crucial challenge that the cryptocurrency community continues to address.

The Potential Challenges to Crypto Adoption

One significant challenge to the widespread adoption of cryptocurrencies is regulatory uncertainty. Different countries have various rules and regulations regarding digital currencies. This inconsistency makes it difficult for global acceptance and standardization. Businesses and investors may hesitate to adopt cryptocurrencies due to the fear of sudden legal changes. Clear and consistent regulations are needed to boost confidence in digital currencies.

Market volatility is another hurdle for crypto adoption. The value of cryptocurrencies like Bitcoin and Ethereum can fluctuate wildly in short periods. This unpredictability makes it challenging for businesses to price their goods and services. Additionally, consumers may be reluctant to use cryptos for daily transactions due to fear of losing value. Stability is essential for cryptocurrencies to be seen as a viable alternative to fiat currencies.

Security concerns also play a role. While blockchain technology offers high security, the platforms and wallets used for transactions are sometimes vulnerable to hacking. Instances of crypto exchanges being hacked and losing millions of dollars are not uncommon. Such security breaches can deter users from entering the crypto market. Enhanced security measures are crucial to safeguard digital assets and build user trust.

Another challenge is the technical complexity of cryptocurrencies. Many people find it difficult to understand how digital currencies work. This lack of understanding can create a barrier to adoption, especially among older generations. User-friendly platforms and educational initiatives are needed to make cryptocurrencies more accessible to the general public. Simplifying the user experience is key to broader acceptance.

Environmental concerns are also gaining attention. Cryptocurrency mining, especially Bitcoin, consumes a massive amount of energy. This has led to criticisms about the environmental impact of cryptos. Finding sustainable solutions for mining operations is essential. Alternatives such as proof-of-stake mining could offer more eco-friendly options.

Lastly, mainstream acceptance is still evolving. Major companies and financial institutions are gradually adopting cryptocurrencies, but many are still cautious. Public perception and trust need to grow for cryptocurrencies to become widely accepted. Efforts to demystify digital currencies and educate the public can help in overcoming this barrier. The journey toward widespread crypto adoption is ongoing.

Frequently Asked Questions

Cryptocurrencies are gaining traction in the financial world. Here we address some common questions to help you understand this evolving ecosystem better.

1. What is a cryptocurrency?

A cryptocurrency is a digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology.

This decentralization makes them immune to government interference and control. Popular examples include Bitcoin, Ethereum, and Litecoin, each with unique features and applications.

2. How does blockchain technology work?

Blockchain is a distributed ledger technology that records all transactions across multiple computers. Each transaction forms a “block,” which links with others to form a “chain.”

This distributed nature ensures data integrity and security since altering any block requires changes in all subsequent blocks across the network. It’s used not only in cryptocurrencies but also in various other applications like supply chain management and medical records.

3. Why do people invest in cryptocurrencies?

People invest in cryptocurrencies for several reasons, including potential high returns, diversification of investment portfolios, and interest in emerging technologies. Some see it as a hedge against inflation and economic instability.

The decentralized nature of cryptocurrencies also appeals to those who prefer financial systems without central authority control. Nevertheless, investing in crypto comes with its own set of risks due to market volatility.

4. Are cryptocurrency transactions secure?

Cryptocurrency transactions are generally secure due to advanced cryptographic techniques used in blockchain technology. However, the platforms where these transactions occur can sometimes be vulnerable to hacks.

Users should employ strong security practices such as using hardware wallets and two-factor authentication (2FA). Always verify the credibility of exchanges before engaging in transactions to ensure safety.

5. Can I use cryptocurrencies for everyday purchases?

Certain businesses now accept cryptocurrencies like Bitcoin for goods and services making it increasingly viable for everyday use. From buying coffee to booking flights, options are expanding continuously.

You can also convert your crypto into fiat currency using digital wallets or payment apps integrated with banks. However, it’s essential to stay updated with regulations as they vary across regions.»

Conclusion

In summary, the world of cryptocurrencies presents a promising yet complex landscape. Their speed, security, and decentralization offer advantages over traditional fiat systems. Yet, challenges like regulatory uncertainties and market volatility cannot be ignored. As adoption grows, these digital currencies may transform the future of finance.

Continued innovation and regulatory clarity will be key in overcoming existing hurdles. By addressing these challenges, cryptocurrencies can achieve broader acceptance. Their potential to reshape global financial systems is significant, making them an area worth watching closely. The evolution of digital currencies is likely to continue at a rapid pace.